Before you invest in a DXP...

Learn about:

The top navigator for DXPs, the Gartner Magic Quadrant is a research methodology that can be applied to DXP providers to gauge where each lies in the market, their key strengths and weaknesses, and where they are in relation to each other. Gartner is an expert market analyst, so when they report, we listen. They've been here with their market research on DXPs when they were in their CMS form, later changing the title to match. This blog will show you how to use their report to make your DXP decision.

Brief overview of Gartner Magic Quadrant

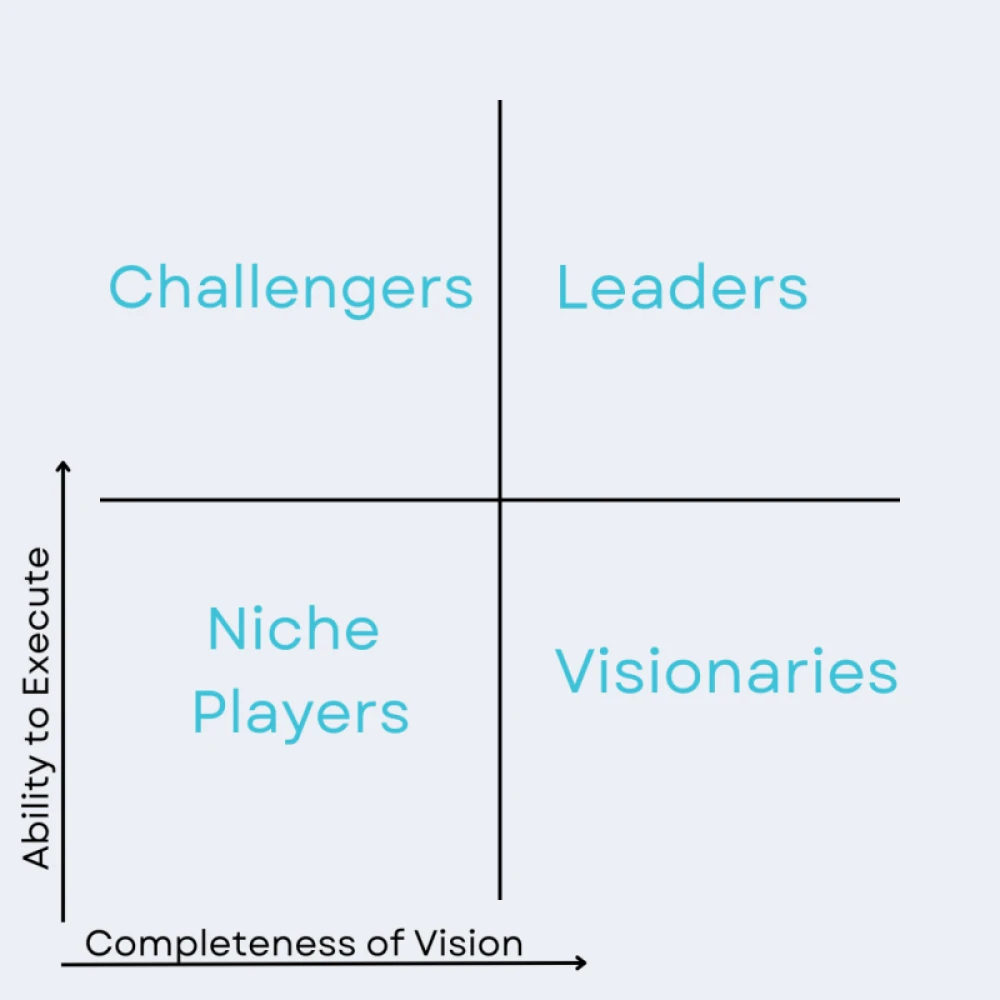

The Gartner Magic Quadrant is a graphical depiction of competitors in a specific, growing market.

Gartner sections companies into the quadrants of Challengers, Leaders, Niche Players, and Visionaries.

These labels shouldn't necessarily be viewed as one ranking above the other, but as options that may fit your business better than another.

At first glance it may seem like adopting a leader DXP is a no-brainer, but they aren't always the best choice; picking a quadrant depends on the goals of your business.

Explained below, the Magic Quadrant measures a vendor's position in the market by the factors "ability to execute" and "completeness of vision."

Measures of Magic Quadrant

Ability to execute

The ability to execute is determined by the elements including the vendor's financial growth, sales channels, market reaction time, product development, and clientele.

Completeness of vision

The completeness of the vision refers to a vendor's capacity for innovation. These are vendors that drive the market and follow it closely.

How to interpret each quadrant:

Once you know how to read it, the Gartner Magic Quadrant provides useful information about the DXP you're looking for so you can make a strategic investment. Here's an explanation of each quadrant position and an example DXP vendor positioned by Gartner in 2022 with its respective label.

Challengers

Challengers may not have a great strategy for acquiring new clients despite having a strong Ability to Execute. Because of their decision to go the low-risk route and not interfere with their clients' or internal operations, larger vendors in mature markets may be classified as Challengers.

Although Challengers may have an ample amount of resources, they may lack a clear vision, creativity, or a limited understanding of market demands. This quadrant may reflect vendors that have a dwindling niche or segment against their competitors. Through product cycles and as demands change, large companies may drift between being Challengers and Leaders. Also, as their vision develops, Challengers may become leaders in the market.

Example: Oracle

Oracle stands out for its broad B2B and B2C creation, personalization, and integration features. They have a global presence in the DXP market and gained recognition from Gartner for their adaptability based on their client's strategic and execution needs. Although, a criticism from Gartner is that Oracle may be losing sight of its DXP objective.

Leaders

Leaders typically have a large client base that is overall satisfied with the vendor's service. These are the vendors that deliver well-developed products and have proven over time to have the expertise and vision to stay afloat with a consistent market position. However, these vendors are the ones to keep an eye on as you predict how competitors may gain traction in the market. In general, leaders promote broad market demands for a broad market audience.

Example: Acquia

Similar to Adobe's product as they're geared toward B2B and B2C uses, Acquia offers an Employee Experience Solution to improve the design experience and for those routing customer journeys. Acquia is set apart for this reason and Gartner praises the vendor for its Site Studio feature, a builder that requries low or no experience in code.

Niche Players

Niche players excel in hyper-specific market segments or have a constrained ability for innovating and surpassing rival vendors in the larger market. They can be a Niche Player for several reasons; the vendor may specialize in a certain functionality or target a geographic region, especially if they are new to the market. On the other hand, the Niche Player may be struggling to survive in a market that is losing interest in their services.

Despite having a relatively narrow client base and limited resources, they may offer comprehensive functionality but don't present a competitive vision for the broader market. Long-term viability can be threatened by a vendor deviating from market trends, so this is a red flag to be aware of.

So long as the Niche Player goes in the direction of the market as a whole, this can be an ideal choice for your business.

Example: CoreMedia

CoreMedia offers a lean architecture with an emphasis on optimizing e-commerce interactions. Highly expandable, this vendor has a wide variety of integrations with platforms like SAP Commerce Cloud, Salesforce Marketing Cloud, and Salesforce Commerce Cloud. However, Gartner warns potential CoreMedia clients to consider the longevity of the vendor by closely evaluating product strategy needs.

Visionaries

Although Visionaries align with the route of development that Gartner looks for in their evaluation, it's unclear how well they will execute their visions, which is a common situation in less established markets. This could look like vendors that have a competitive strategy by selling ahead of popular demand instead of strictly following trends so that they may stand out from the competition. Visionaries take risks in hopes of a high reward and may need to cultivate a backbone of financial stability, customer services, and distribution for sales and marketing. These are the vendors that provide new technology, and their customers' response can establish customer loyalty which projects the vendor toward becoming a Challenger or Leader in the market.

Example: Bloomreach

Bloomreach approaches the DXP market in a novel way by dividing its attention into: discovery, engagement, and content. Clients benefit from the vendor's no-frills layout and can take the reins on their DXP. Bloomreach supports a gradual implementation of its solution, though Gartner warns this approach can limit its go-to-market strategy.

What quadrant DXP is best for your business?

Interactive Magic Quadrant features

If you need a deep dive into the DXP market according to Gartner, you can use their interactive Magic Quadrant features (if you're an entitled Gartner client) and add your own best-fit line into the equation to see which vendors click with the goals and needs of your business.

The quadrants' pros and cons

The Magic Quadrant should be tested against your business's requirements and needs and not seen as a cut-and-dry judgment of the DXP vendors you're shopping for. Price, functionality, security, industry, and location are some factors that, for instance, a Niche Player vendor could have where a Leader may not.

Shop around and observe the features of DXPs in every quadrant before investing in one that seems to be at the top of the market.

If you're looking for a vendor with high viability in the market that can withstand change, focus on a DXP with the Ability to Execute over their Completeness of Vision. Consider Challengers over Visionaries in this case.

In the same vein, if you seek a competitive advantage with new technology, take a risk with a Visionary vendor rather than Challengers.

Gartner's 2022 DXP positioning

Though you must be a Gartner client to see their full analysis of the DXP market and its vendors, we can draw conclusions based on their explanation of the quadrants.

Typically, mature markets have a Magic Quadrant where vendors cluster up in the Leaders section. Per the 2022 DXP positioning, this growing market has more vendors in the Niche Players and Challengers quadrants.

Leaders

Adobe, Acquia, Optimizely, and Sitecore were named as Leaders by Gartner in February 2022. These vendors have so far maintained their leadership status despite DXPs being a growing market. Simply, these are cornerstone DXPs that can affect the trajectory of the market as they invest and evolve individually.

Challengers

Oracle, Salesforce, HCL Software, Open Text, and Liferay were labeled as Challengers in the DXP space. These groups are more established in the DXP market and are climbing as possible leaders. With their low-risk, plentiful resource status, these vendors are seemingly built for long-term use in the market but are likely stagnant with their vision.

Visionaries

Bloomreach and Magnolia are the lone wolves in Gartner's 2022 research, both of which were named Visionaries that offer a range of DXP integrations and content management possibilities. These vendors have a higher value when it comes to Completeness of Vision, which is promising for building viability in the market.

Niche Players

CrownPeak, CoreMedia, Progress, Kentico, and Squiz are the Niche Players of DXP vendors.